Production Planning within a Seasonal Industry

Originally Posted: March 02, 2016

One challenge facing companies that manufacture products with highly seasonal demand is the choice of production scheduling. One option is to make a fraction of the expected demand each month leading up to the peak season. But, when demand is uncertain this approach can lead to large overages or shortages that erode margins. Firms that find themselves in this situation must balance the costs of ramping production to meet demand during peak season, additional inventory holding costs, and the risk of uncertain demand.

The case of Play Time Toy Company1 is used to explore solutions to this dilemma. Specifically, using Monte Carlo analysis to assess the impact of production scheduling on firm profitability and capital requirements.

Note: The code developed to model Play Time and generate the plots in this post are available here.

Business Environment

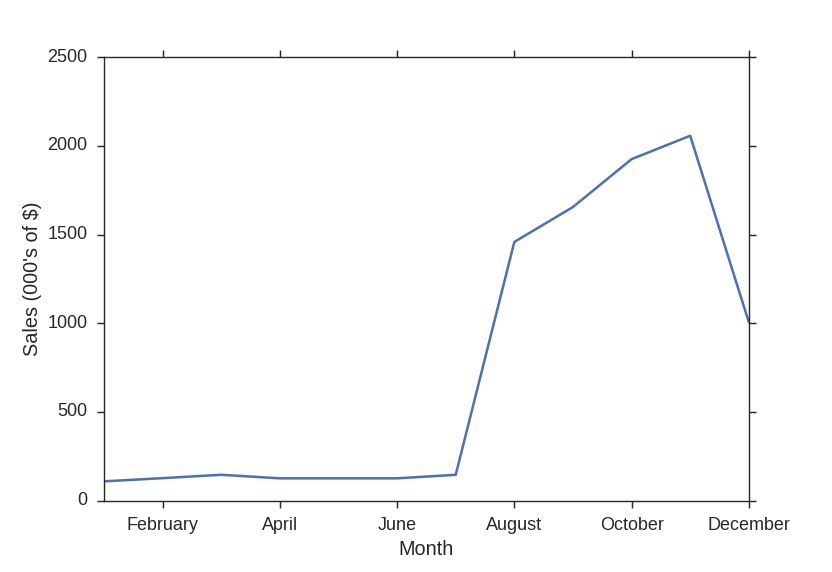

Play Time Toys is a US based toy company that is faced with increasing competition from foreign firms. Their yearly sales have been growing steadily but this growth has been the result of successful “Fad” toys that boost sales for just a single season. As a result, their sales have varied by as much as +/- 30% year over year. In addition, the vast majority of their sales are received in anticipation of the holiday season, and are from big box toy stores that pay for orders within 60 days. The projected sales for 1991 are shown in Figure 1.

In order to mitigate some of the risk associated with the seasonality of their business, Play Time currently manages production scheduling in a make to order fashion. This allows them to respond to customer demand rapidly but is more costly than level production throughout the year because they must hire and train a large holiday workforce. Due to the increased pressure from competition, they are considering shifting their production strategy away from a make to order approach to reduce costs.

In moving to level production, Play Time has several issues to consider. Some of these are:

1. Financing: They currently have a limited amount of cash on hand so they use a line of credit for additional working capital. This is limited to $1.9 M without further negotiations with the bank and it must reach a zero balance for at least one month each year. Any required increases in working capital due to the change to production scheduling need to be evaluated.

2. Inventory Costs: Moving to level production will certainly reduce hiring costs associated with a seasonal workforce, but how this compares to the cost of holding additional inventory needs to be considered.

3. Uncertain Demand: Perhaps the greatest challenge is the reliance of their sales growth on fad toys. If Play Time develops a toy that is a flop, under the level production approach they will be left with a large volume of worthless inventory.

Within the context of the case, there isn’t enough information to assess the risk of fad toys on Play Time’s business, but there is enough information to explore the first two issues listed above.

Make to Order Versus Level Production

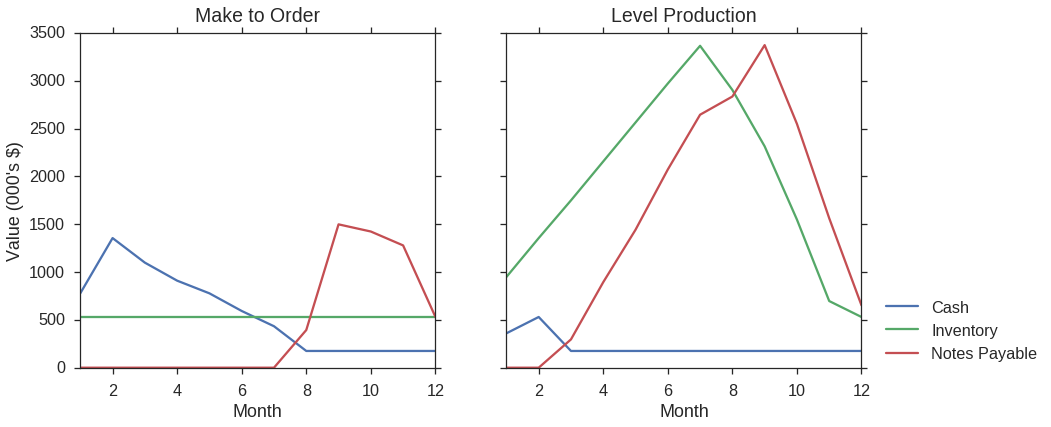

Play Time’s current approach to production involves waiting for a customer order and then pushing that order through their production system as quickly as possible. This approach requires them to have a significant amount of excess capacity that is only used during the holiday season, and each year they must hire and train a temporary workforce capable of meeting their quality standards. In order to break out of this cycle, Play Time wants to shift to a level production environment where they will produce at a fairly regular rate over the course of the year building up inventory to be sold during the busy season. Figure 2 compares the impact of these two approaches on Play Time’s cash, inventory, and credit line with the bank.

The fundamental differences between the two approaches are readily visible in Figure 2. In the case of a make to order system, inventory stays at a constant level but in the level production environment inventory accumulates until it is sold off during the holiday season.

In addition, the impact on required working capital is immediately apparent. In the make to order case, the credit line is only needed during the busy season when customers place large orders but don’t pay until 1-2 months later. In the level production scenario, they begin to use their credit line in month 3, exceed their limit in month 6, and it is unclear whether they will be able to meet the requirement of maintaining a zero balance for at least one month a year. Thus, if Play Time wants to shift to level production, they will have so much capital tied up in their inventory that they will need to renegotiate the terms of their credit line with the bank.

Using Monte Carlo to Find a Middle Ground

At first glance Play Time’s situation seems hopeless. But, in reality they are considering two production schedules that are polar opposites of each other. Currently they make everything to order and hold zero inventory, and they want to move to an environment where they make at a steady rate all year long while holding tremendous amounts of inventory. But what about all of the scenarios in between those two extremes? What if they begin ramping up production three months before peak season? How much of the cost savings from increased utilization and reduced seasonality of production would this deliver? The Monte Carlo method can be applied to a model of Play Time’s finances to assess the impact of different production schedules on the firm’s profitability.

A Toy Model

Using Play Time’s balance sheet from the end of 1990 and their projected sales for 1991, the company’s finances for 1991, such as working capital requirements and inventory volume, can be built out based on different production scenarios.

Note: I am being purposefully vague about the model because this is a teaching case and I do not wish to provide a solution as much as I do an illustration of what can be done. Readers interested in the details of the model should explore the Github repository mentioned at the start of the post.

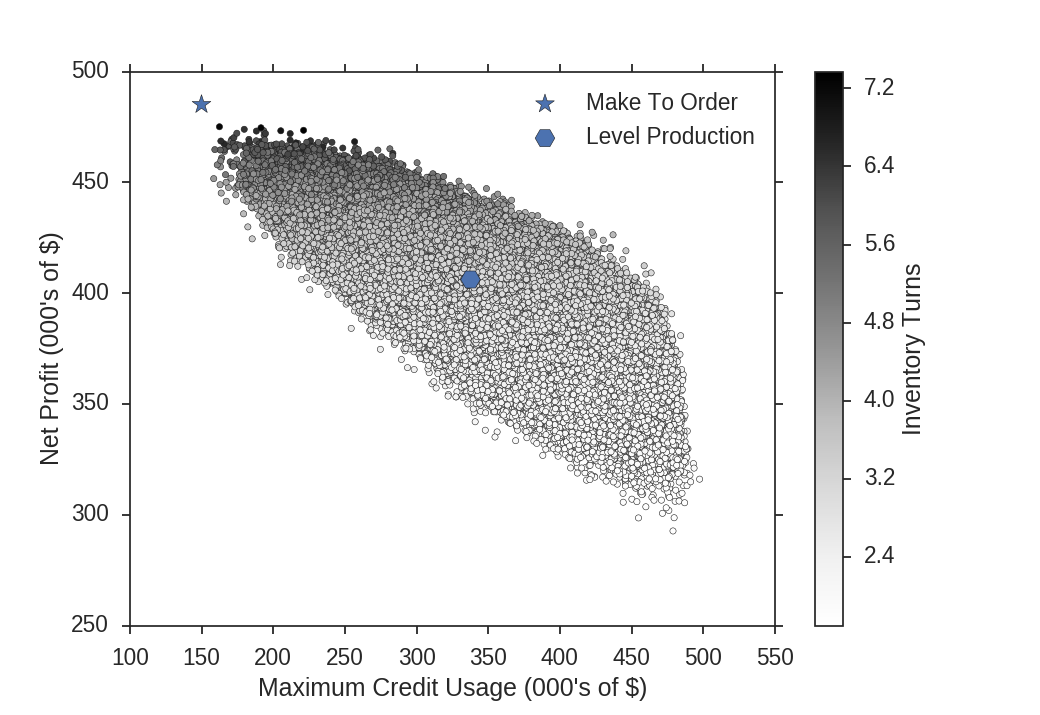

The Monte Carlo method can be applied to this model of Play Time by drawing a random set of production weights corresponding to each month of the year. These results are shown in Figure 3 along with Play Time’s current make to order scheme and their level production proposal. Each trial is plotted based on the expected maximum credit line usage and net profit for 1991, and is shaded based on inventory turns for the year.

From these results, we can see that there is a rich variety of production schedules in between the two options that the company is considering. It is interesting to observe the frontier where net profit is maximized for a given level of credit usage, and that Play Time’s proposal of level production is far from this frontier. This indicates that the proposal isn’t optimal for the firm, even if they are able to renegotiate with the bank.

Current Options

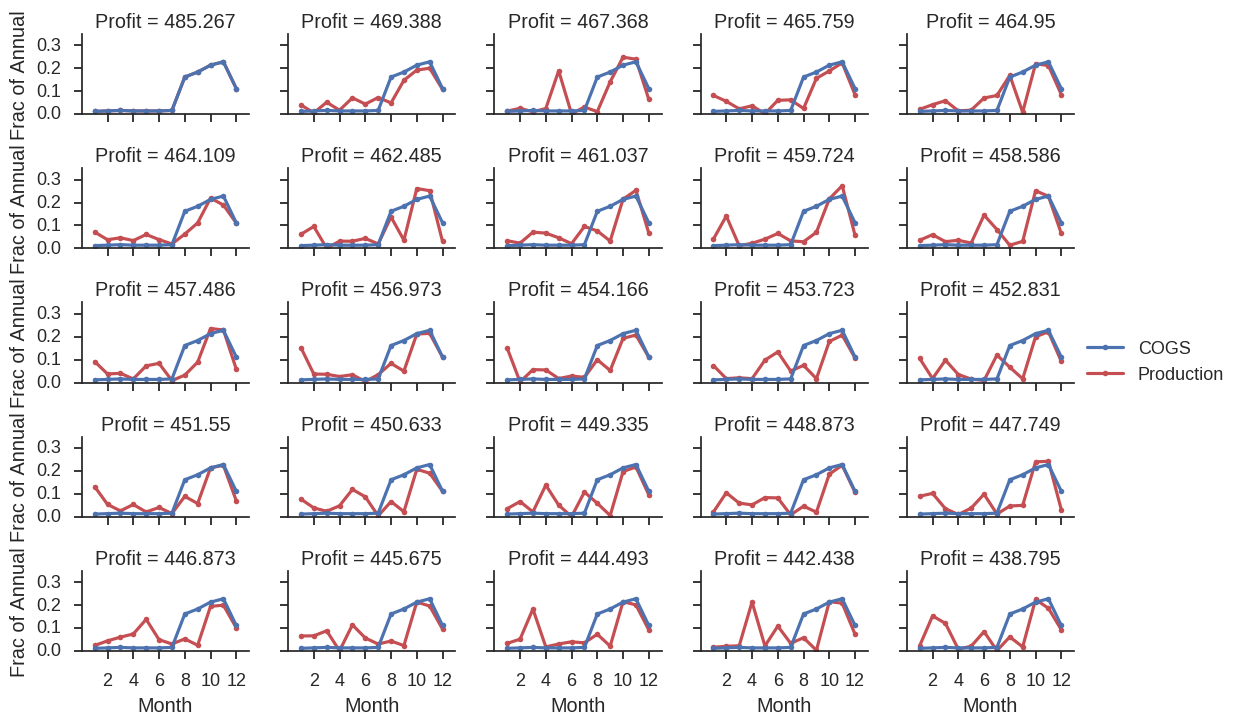

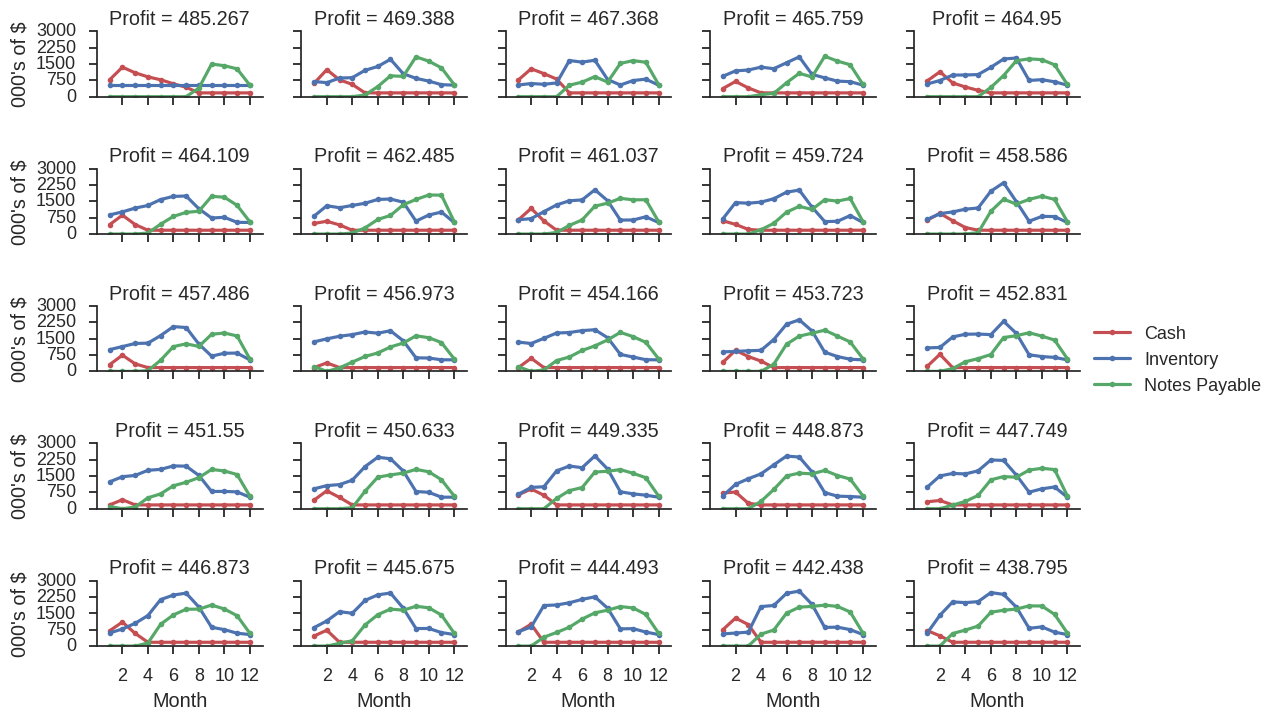

Moving beyond their completely make to order approach, there are many options that lessen the seasonality of production but do not require renegotiating with the bank. The detailed production schedules and basic financial metrics for a selection of these options are sorted by their profitability and presented in Figures 4 and 5. Without more detailed information on Play Time’s costs, it is difficult to estimate the cost savings achieved by moving toward level production. Thus, the make to order approach tops the other options in terms of profitability. But, it can be seen quite clearly that as production is moved earlier in the year, the working capital requirements increase. Since this capital is coming from their line of credit, the interest payments erode margins and reduce Play Time’s overall profitability.

Conclusions

When considering production scheduling, we need to evaluate the range of possible scenarios to find the approach that best balances the firm’s objectives. Specifically, there is a frontier where the return on invested capital is being maximized, so the firm should identify this frontier and ensure that their choice lies on it. Lastly, in the case of Play Time, if they continue growing their working capital requirements will exceed what is provided to them via their credit line from the bank. Thus, if they are going to renegotiate their financing terms with the bank in order to enable changing to a more level production approach, they should also consider their long-term capital requirements.

References

- Piper, Thomas R. “Play Time Toy Co.” Harvard Business School Case 292-003, October 1991. (Revised November 1993.)